Corporate Community Investment

Corporate Community Investment (CCI) is a mode of ‘giving’ by large businesses in Australia and internationally, and often a separate practice area within the corporate public affairs management function, often residing in the corporate responsibility business unit.

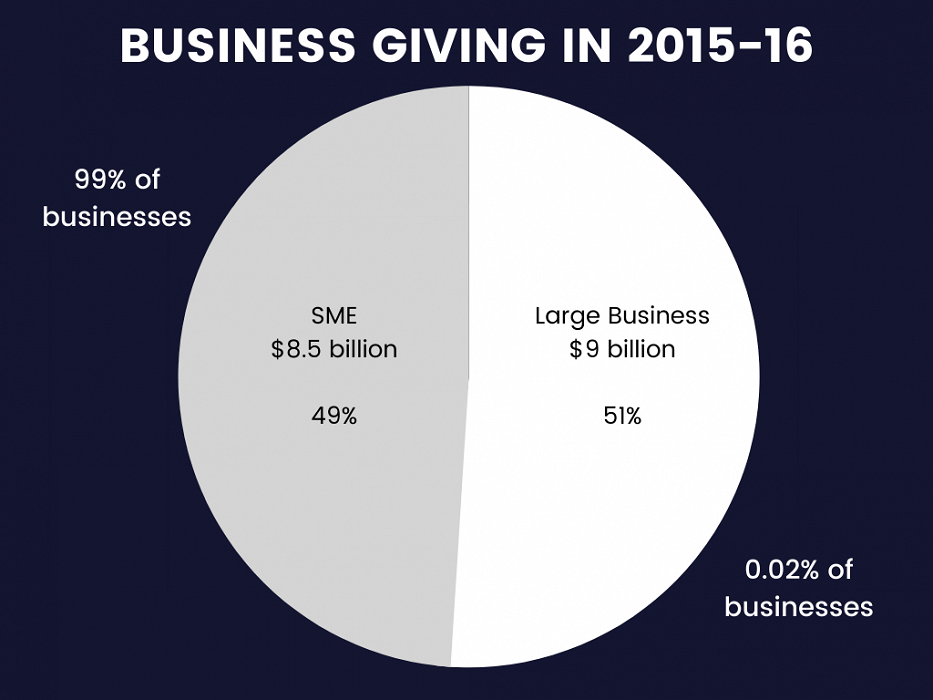

According to the Centre’s report Giving Australia 2016: Business giving and volunteering for the Australian Government in 2017, there was a big leap in the value and modus operandi of business ‘giving’ in Australia since 2005, and corporate community investment in particular, with giving by small, medium, and large businesses reaching A$17.5 billion. Partnerships with non-profit organisations to generate positive social impacts has emerged as the preferred way that the largest businesses give in the community.

Compared to the last Giving Australia report in 2005, and the Centre’s 2007 report to the Prime Minister’s Partnership on Corporate Community Involvement, community investment is far more embedded in the way many small, medium, and mid-tier enterprises do business. For corporations, community investment is a strategic imperative to the business and its social license to operate.

The most common mode of community investment in Australia is corporate partnerships with not-for-profit entities or in partnership with government departments and agencies.

In other parts of Asia Pacific, especially South-East Asia and the US, corporate community investment involves significant philanthropy and strategic philanthropy: in the UK and other parts of Europe, corporate partnerships comprise the lion’s share of the community investments by large corporations.

The Centre’s 2016 Giving Australia research concluded less than one per cent of large businesses – corporations – gave $9 billion in their last financial year, representing 51 per cent of total business giving. Corporations gave an average of $4.9 million per organisation.

Corporations were responsible for $7.9 billion of giving by large business (88 per cent of all total large business giving). For these businesses, giving is no longer an exotic or bolt-on optional extra. It is embedded in business strategy and is overseen by boards, the CEO, and her/his executive management teams.

Corporate community investment practitioners frequently have a background in stakeholder engagement, sponsorship management (marketing sponsorships are not ‘giving’ or community investments), corporate responsibility, and community relations.

According to CEO and Board Members interviewed for the research underpinning the Giving Australia report the main drivers of CCI are employee engagement, social impact, ‘doing the right thing’, and community expectations.

This is similar to the drivers across Asia Pacific, although in South-East Asia, North Asia, the US, and the UK ‘corporate reputation’ is among the top three drivers of corporate community investment.

Related resources from the Centre's Knowlede Centre...

Taken for granted? Charities’ role in our economic recovery

Social Ventures Australia and The Centre for Social Impact investigate the state of Australian charities during COVID-19, and how decisions made now will strongly impact whether charities will be “COVID-19 casualties or...

REPORTSExplore the Centre’s Knowledge Centre

Browse more Community Investment resources in the Knowledge Centre.